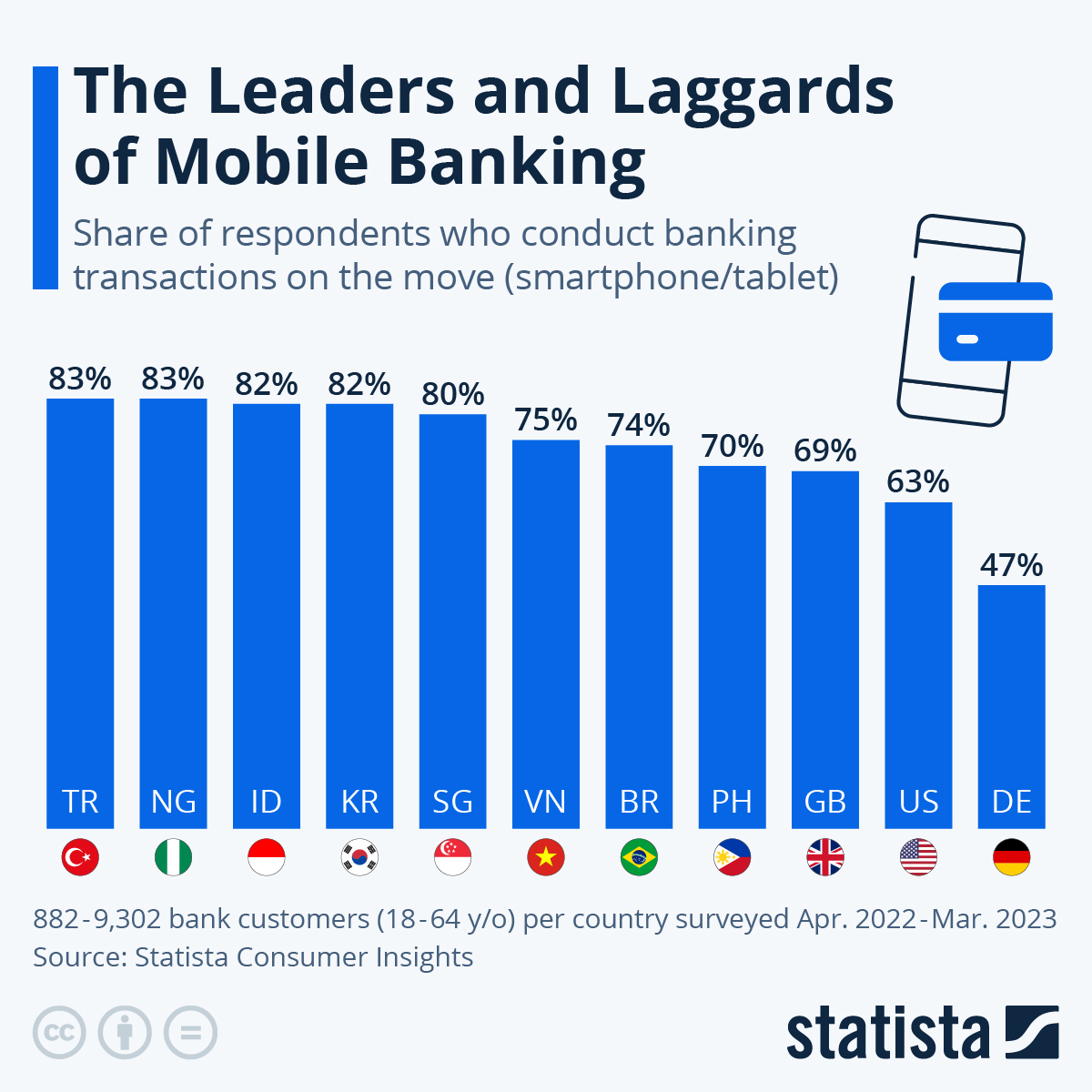

Turkey and Nigeria tied in top place as the countries with the highest share of mobile bankers, with 83 percent of respondents in each country saying it was how they carried out their transactions. This is according to data from a Statista Consumer Insights survey, carried out between April 2022 and March 2023 across 56 countries.

In both cases, mobile banking surpassed classic online banking, with only 50 percent of Turkish respondents using a PC or laptop for their banking, versus 31 percent in Nigeria. In Turkey, telephone banking was the second most popular option (56 percent of respondents) while in Nigeria it was going into a branch in person (67 percent). The writers of Statista’s report ‘The rise of ecommerce across Africa’, explain that in the case of Nigeria at least the trend is partly due to the relative affordability of mobile devices versus computers, laptops or tablets in the country.

As this chart shows, several countries in Asia also have a high uptake of mobile banking: Roughly eight in ten respondents in Indonesia, South Korea and Singapore conducted their banking transactions on the move, while in the Philippines a (still high but) slightly lower share of seven in ten respondents picked the same option. In all four countries, mobile banking was the favored mode of banking versus doing it in person, via a browser or over the telephone.

The United States and Germany saw comparatively lower rates of mobile banking usage, at 63 percent, and 47 percent, respectively. In the U.S., mobile banking was the most commonly cited option, while in Germany respondents were more likely to use a PC or laptop (56 percent).