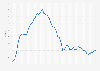

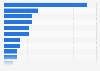

Data from the Central Bank of Russia shows that the country's gold and foreign exchange reserves have been increasing for some time. While at the beginning of 2018 the reserves totaled almost $448 billion in value, this 'war chest' is currently around $630 billion - a growth of 41 percent. "That would be enough to pay for all imports for a year without Russia having to export anything," according to the German Commerzbank's chief economist Jörg Krämer.

Over the weekend however, the West has acted to severely restrict Russia's ability to utilize these reserves, as part of its response to the country's invasion of Ukraine. Among the sanctions imposed, the U.S. announced that it would block dollar assets of Russia’s central bank and its Direct Investment Fund. In announcing the new measures, U.S. secretary of the treasury Janet Yellen said: "The unprecedented action we are taking today will significantly limit Russia’s ability to use assets to finance its destabilizing activities, and target the funds Putin and his inner circle depend on to enable his invasion of Ukraine."

This move has its roots in the more limited U.S. response in 2014 to Russia's annexation of the Crimea. A senior U.S. official is quoted by the Guardian as saying: "When we took those actions, [the Russians] decided that they were going to try and build a war chest to try and defend against the actions that we may take, if they were to take further actions in Ukraine or elsewhere in the world. We knew that this existed and we knew that ultimately, one of the things that we would need to do to ensure that our sanctions would be effective is at some point to go after that war chest and that’s exactly what we’ve done today."