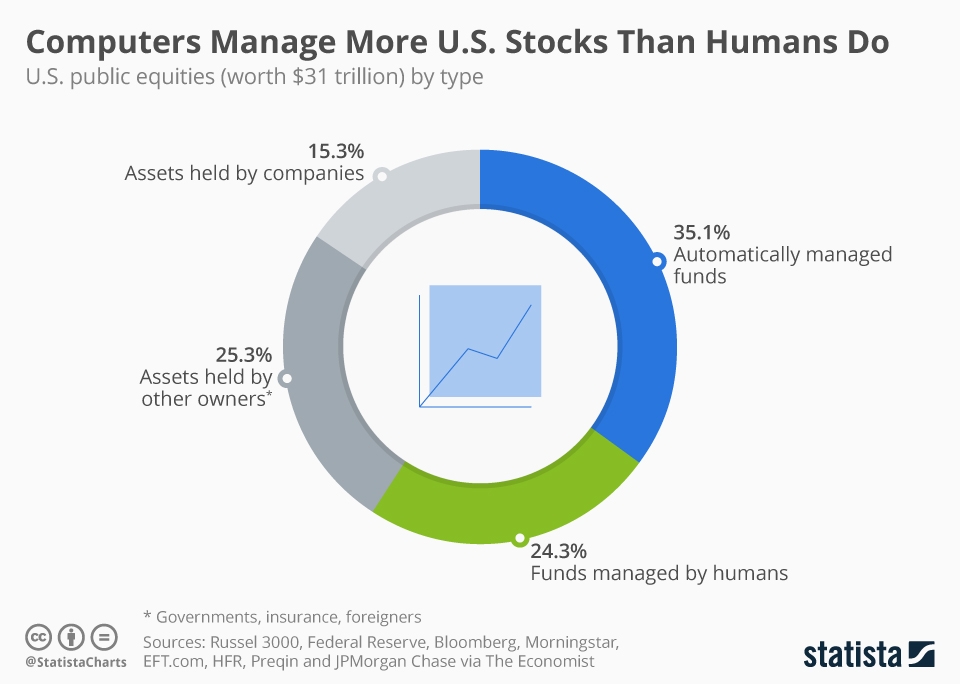

Out of $31 trillion of U.S. equities analyzed by The Economist, more are now automatically managed by computers and algorithms than are managed by humans. According to the report, around a quarter of the stocks analyzed were managed by people while just over 35 percent were managed automatically. The remainder of the equities were held by businesses or other owners like governments and insurance companies.

Simpler computerized stock trading models work by enabling users to set up instructions like sell-by prices for different quantities of stock combined with different other conditions under which to sell or not sell. More sophisticated models take into account a plethora of different conditions, creating their own algorithms to trade by.

While algorithmic trading seems to offer advantages like removing human error and possible failure of judgement from the equation, it has also been criticized. Torsten Slok, chief international economist at Deutsche Bank, has named it the number 1 risk to markets in 2019. In this opinion, the automated equity management has the potential to cause big, concentrated selloffs that increase market volatility or could even send markets into a downwards spiral.